What Is the Easiest Loan to Get Immediately Online?

So you found yourself in a situation where you need to access money as soon as possible? Well, one thing’s for sure – traditional loans from a bank are a no-go, as you might have to wait days, if not weeks, for the decision depending on how many applications they are currently dealing with. Not to mention that if you have a bad credit score, you’re most likely not going to get approved for it.

Does that mean that there’s nothing else for you to do? Of course not! There are actually several other options you can take advantage of that will often give you access to the funds you requested, even on the same day. What are those? Let’s talk about them.

Payday Loans

Are you expecting to get your next salary soon, but it would still be too late for whatever emergency you need the money for? In that case, consider a payday loan. This is a short-term loan that you borrow against your future paycheck.

They usually have a shortrepayment period, but that’s also because they tend to involve smaller amounts of money that you should be able to repay with your salary.

An additional advantage of this type of loan is that there’s no credit score check, meaning that even if your financial history is less than perfect, it won’t affect the decision about whether you’ll get approved for a loan or not.

Personal Loans

Personal loans are loans that you repay in regular monthly installments. Most of them are considered unsecured debt, which means that you don’t have to have a guarantor, nor do you have to use your vehicle or property as collateral.

Nowadays, however, many lenders will allow you to secure the loan using valuables. This not only protects the lender, as they’ll have something they can use to get their money back in case you fail to repay them but, for many people, this serves as great motivation to make all the payments on time.

Another thing is that personal loans have fixed repayment terms and a specific repayment period, which can last from just a few months to a few years, depending on the total amount and how much you pay monthly. The fixability of personal loans means that you can easily budget the money needed for the monthly installment, as you know how much that is beforehand.

Car Title Loans

Auto title loans, as the name suggests, use your vehicle’s title as collateral. The amount of loan you’ll receive depends on the value of your vehicle, although it usually ranges from 25 to 50% of its value. So, if you have a vehicle worth $50,000, you’ll probably receive an offer for a loan between $12,500 and $25,000.

Despite the fact that the lender uses your vehicle to make sure that you’ll repay the loan, they don’t require you to give it up for the repayment period, which is great news for those who rely on their car to get to and from work, or even utilize their car in their job.

One disadvantage of car title loans, however, is that the limits differ between states. If a state has a limit of $500 for car title loans, then even if your car, boat, or other vehicle is worth significantly more than that, you will probably still be offered the maximum permitted amount.

Credit Card Cash Advance

If you have a credit card, you can use it to access emergency funds almost immediately – most credit card companies include that option in your agreement, but if you’re unsure if yours is one of them, check your contract. There should be a section talking about credit card cash advances. Keep in mind that you might have to get in touch with your card issuer in order to receive the PIN code necessary to do the withdrawal.

Despite the fact that the whole process is pretty much the same as with a debit card, credit card cash advances are considered a short-term loan.

Credit card cash advance should be chosen as one of the last resorts, as it definitely has more cons than other types of loans. First of all, there’s no grace period, which means the accumulation of interest starts from the moment you receive the money. Secondly, there are typically additional fees involved aside from interest, which is already high compared to many other loan types, which results in you paying a lot more than you borrowed.

Peer-to-peer Loans

Peer-to-peer lending, also known as crowd lending or social lending, is a type of lending where the money is not lent by a financial institution but by an individual, typically through a website that connects borrowers to lenders.

Just like any other type of lending, this one also has its pros and cons. What definitely works in their favor is that there’s no middleman – there’s only the person borrowing money and the person lending it.

However, it might not be the best option for those with a bad credit score, as in most cases, it’s what determines the borrower’s creditworthiness and is a decisive factor in the interest rate they will have to pay.

What to Remember When Considering a Loan

Choosing the right type of loan can be hard, so here are a few things you should take into account before you make the decision:

- Interest rate – Even loans of the same type can have different interest rates depending on the lender, so it’s crucial that you always check what the interest rate of the specific loan you’re considering is.

- Repayment terms – Many loans have short repayment periods, which can be great if you are sure you will have the money within the specified time window. However, if you have even slight doubts about whether you’ll be able to repay the loan on time, either try a completely different loan or, if you can, extend the repayment period. It’s better to pay smaller installments longer than find yourself unable to repay the loan at all.

- Lender – Choosing a trustworthy lender to borrow from is one of the most important aspects of applying for a loan online. At Income Tax Loans Now, we have managed to build a network of reliable and trusted lenders, so you can be sure whoever we refer you to adheres to our standards.

The Bottom Line

If you find yourself needing access to money as soon as possible, there are a few different options for you to choose from, with easy approval payday loans, personal loans and car title loans being just a few of them. The application process typically takes a few minutes, and in many cases, you can have the money in your bank account as soon as on the same day.

At Income Tax Loans Now, we understand that emergencies happen, which is why we offer our customers probably the easiest payday loan online, where you can have access to funds even within an hour! Want to know more? Get in touch with us today!

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

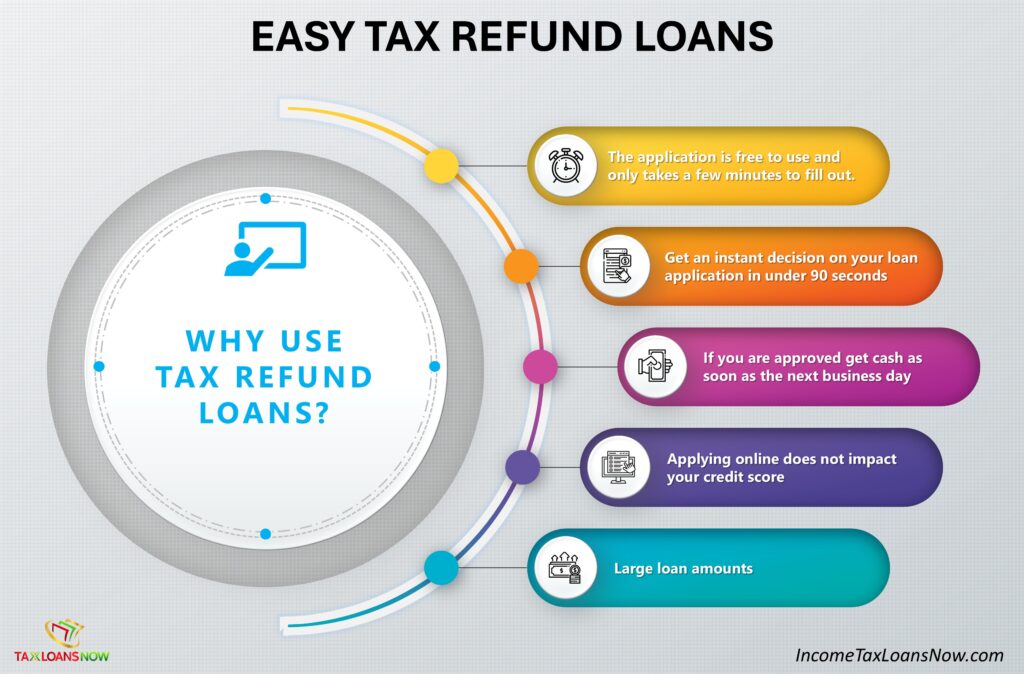

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...