How to Pay for Car Repairs with No Money

Maybe you’ve been there before; cruising down the highway when suddenly a dashboard light pops on or your engine starts making a strange noise.

You pull over and realize you’re facing a costly auto repair, but your bank account balance is low and payday is still a week or more away.

Situations like this can be scary and stressful. But don’t panic. With some planning and resourcefulness, you can figure out how to pay for emergency car repairs even when funds are tight.

This guide will walk you through how to pay for car repairs with no money and how to get a loan for car repairs. With a little effort, you can get your car back on the road quickly while keeping your finances intact.

Talk to Your Mechanic

When you get the repair quote from your mechanic, have an honest discussion with them about your financial situation. Many mechanics are willing to work with customers who are going through temporary hardships.

Ask if they offer payment plans to break up the total cost into more manageable monthly payments. This allows you to get the necessary repairs done now while paying it off slowly over time.

Inquire about potential discounts for paying in cash or upfront. Some mechanics provide small discounts for not having to send invoices and wait for payments.

See if used or refurbished replacement parts are an option instead of brand new parts. While you want quality parts, used parts can still have plenty of life left while costing much less.

Most mechanics understand that car repairs are often unexpected expenses and strains on your budget. Go into the conversation with a polite and grateful attitude. They may be able to find ways to reduce the labor costs or part charges.

Being upfront about your financial limitations can help the mechanic provide solutions tailored to your situation. Don’t wait until after the repairs to explain you can’t afford to pay the full amount.

Use Community Resources

Looking for assistance from community organizations and government programs can be a lifesaver when you’re strapped for cash and need car repairs. Here are some options to explore:

- Research local charities or donations for car repairs – Many nonprofit organizations have funds set aside to help people in financial hardship. Search online or call around to charities, churches, shelters, food banks etc. in your area to explain your situation and see if they can contribute anything towards your auto repairs.

- Check if churches or nonprofits offer assistance – Some faith-based groups and community organizations have programs in place to help people with critical car repairs and maintenance. They may be able to cover all or part of the costs, especially if the repairs are essential for you to get to work or take care of your family.

- Look into government programs – Your local Department of Social Services may have emergency assistance programs to help pay for car repairs for qualifying individuals. Or your state may have special funds available for low income households – contact them to learn more. Government grants could potentially cover auto repair costs in certain situations.

Pay With Your Credit Card

Putting an auto repair on a credit card can provide a short-term solution if you need to get the work done but don’t have the cash on hand. This approach allows you to pay off the balance over time. However, this option does come with some downsides.

The main benefit of paying with a credit card is that it allows you to complete the necessary repairs right away, even if you don’t have the funds available. This can be helpful to get your car back on the road quickly.

However, this option can be very expensive in the long run. Credit cards tend to have high interest rates, typically 15% or more. So if you carry a balance, that debt can grow rapidly as interest accrues. Even a seemingly small $500 repair bill can turn into thousands of dollars in interest charges if you only make minimum payments.

It’s wise to avoid this option if at all possible. Putting auto repairs on a credit card should only be considered as an absolute last resort. Even then, you’ll want to pay off the balance in full as soon as possible to avoid accruing interest charges. The high rates can put you in a cycle of debt that is difficult to escape.

If you do go this route, try to find the lowest interest rate card available to minimize finance charges. But understand the risks – credit card debt can spiral out of control quickly. Weigh all other options first before resorting to this expensive approach for financing your car repairs.

Borrow from Friends or Family

If you don’t qualify for a loan or don’t want to take on more debt, borrowing money from friends or family can be an option to cover car repairs. However, it’s important to approach these situations carefully to avoid straining relationships.

When asking for money, be upfront about why you need the funds and how much you need to borrow. Explain how and when you plan to pay it back. Offer to sign a simple loan contract detailing the repayment terms.

Decide on an interest rate, if any, and stick to the repayment schedule. Even small amounts can lead to hurt feelings if not repaid. Make payments on time and keep lines of communication open.

If you cannot repay the full amount by the deadline, ask for an extension as soon as possible. Don’t avoid the person or conversation. Apologize, explain why you need more time, and offer a new realistic repayment plan.

Borrowing from loved ones can negatively impact relationships if not handled with care, honesty, and accountability. Make sure you only borrow what you can realistically pay back to maintain trust.

Take Out a Personal Loan

Taking out a personal loan from your bank or credit union can provide funds for car repairs when you’re short on cash. With a personal loan, you’ll get a lump sum upfront and repay it over time in fixed monthly payments.

Personal loans for car repairs typically range from $1,000 to $5,000. You’ll need to qualify based on your credit, income, and existing debt obligations. The repayment term is usually 1-5 years. Interest rates can vary widely but may range from 5% to 36%.

Before taking this route, be cautious of high interest rates and fees. Personal loans essentially allow you to borrow money against your future income. Defaulting on payments can damage your credit score. Analyze your budget to ensure you can manage the monthly repayment amount and have a plan to pay it off quickly so interest costs don’t accumulate.

Also, research lending alternatives like borrowing against your 401k or taking out a home equity loan, which may offer lower rates. Avoid payday loans or car title loans, which charge excessively high interest rates and can trap borrowers in cycles of debt.

If you’re in a rough financial situation, Income Tax Loans Now can help. Apply now or get in touch with us – you might be able to receive the funds you need the very next day.

Final Thoughts

The most important thing is not ignoring a serious repair just because you lack funds. With some creativity and effort, you can usually find an affordable solution. Don’t be afraid to ask for help or negotiate – you may be surprised at what can work out.

In case you have any doubts, contact us today! We’ll answer your questions and help you come up with the best solution.

Marie Phillios

Author

Marie is a contributing author to our blog. She has over 1o years experience in media and publication. She specializes in finance.

Related Reading

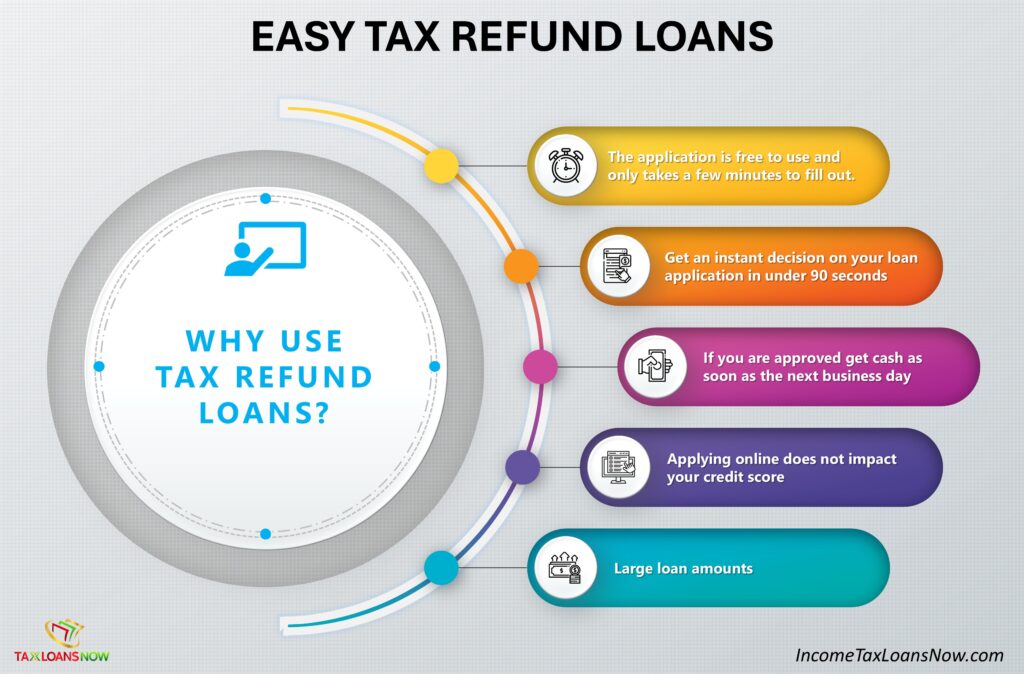

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...