Ever wondered how to get your tax refund faster? Well, you’re not alone. Each year, countless Americans eagerly anticipate the arrival of their tax refunds, and for a good reason. It’s often a reasonable sum of money that individuals want to put to good use as soon as possible. But what if there’s a way to get your hands on that cash sooner? Enter tax refund loans, the perfect solution for early filers.

Tax refund loans can be a lifeline for those who need their refund early. But where do you get such a loan? Well, several providers offer this service. Obviously, our service at Income Tax Loans Now is dedicated to offering quick and easy tax refund loans to help taxpayers access their refunds sooner, with loans ranging from $100 to $5,000.

But today, we’re going to focus on three of the big players: Jackson Hewitt, H&R Block, and Intuit TurboTax. We’ll break down what tax refund loans are, how they work, and what to consider before applying.

What are Tax Refund Loans, and How Do They Work?

Refund Advance Loan, Tax Refund Loan, Tax Refund Anticipation Loan, and Tax Advance Loan are all terms that refer to the same concept. Despite the different terminology, they all serve the same purpose, essentially short-term advances on a tax refund you expect to get. The loan amount can be as much as your total refund but is subject to the specific lender’s policies.

When you apply for a tax refund loan, the lender assesses your tax situation to determine how much your anticipated refund will be. If approved, the lender will issue you a loan for that amount. Once your actual tax refund arrives, it goes directly to the lender to pay off the loan.

Applying online with Income Tax Loans Now is an easy process; you can find out how it works here.

But why would anyone want to get a tax refund loan? There are a few reasons. But the main one is it allows you to access your refund money early. Pay off those urgent bills, get that holiday booked early, or just the peace of mind from having that cash in hand.

Major Providers of Tax Refund Loans

There are three providers that stand out from the crowd in the tax refund loan market – Jackson Hewitt, H&R Block, and Intuit TurboTax. These companies have established themselves as leaders in the field, offering a range of services to help taxpayers access their refunds early.

Jackson Hewitt Tax Refund Loans

Founded in 1982, Jackson Hewitt has grown to become the second-largest tax-preparation service in the USA, responsible for preparing over 2 million federal, state, and local income-tax returns each year. With a strong retail presence, Jackson Hewitt has more than 6,000 franchised and company-owned locations throughout the United States, 3,000 located in Walmart stores.

Overview of Jackson Hewitt’s Tax Refund Loans

Jackson Hewitt offers two types of tax refund loans, the Early Refund Advance Loan and the No Fee Refund Advance Loan. Both are issued by Republic Bank & Trust Company. The Early Refund Advance Loan has a 34.22% APR, while the No Fee Refund Advance Loan comes with a 0% APR. The minimum federal tax refund amount required to apply for these loans is $500.

The Early Refund Advance Loan amounts can be $300, $500, or $1,100. At the same time, the No Fee Refund Advance Loan amounts can be $500, $750, $1,000, $1,500, $2,500, or $3,500.

Process of Applying for a Loan with Jackson Hewitt

When applying for a refund advance with Jackson Hewitt, your taxes must be prepared at a Jackson Hewitt office. The Early Refund Advance requires a recent pay stub, the No Fee Refund Advance Loan, a W-2, and other tax documents. Once your loan is approved, funding can be processed within 24 hours if the funds are loaded onto a prepaid card. Funding can take one to five business days if you want the loan via direct deposit into a bank account.

Pros and Cons of Jackson Hewitt’s Tax Refund Loans

One of the main advantages of Jackson Hewitt’s tax refund loans is that the company has numerous locations nationwide, making it convenient for clients to apply in person. However, one potential drawback is that clients must have their taxes prepared by Jackson Hewitt to be eligible for a loan, which may not be ideal for everyone.

H&R Block Tax Refund Advance Loan

H&R Block, a tax preparation company founded in 1955 by brothers Henry W. Bloch and Richard Bloch, has grown into a global entity with operations in North America, Australia, and India. The company has around 12,000 retail tax offices worldwide, offering various tax services, including tax software, online tax preparation, and electronic filing.

Overview of H&R Block’s Tax Refund Loans

H&R Block offers a Refund Advance loan, a no-interest loan repaid with your tax refund. This loan is available for a limited time each year, a short window between January and February. If approved, you could get up to $3,500. The loan has zero finance charges and fees, meaning 0% APR.

Process of Applying for a Loan with H&R Block

You must first meet certain eligibility requirements to apply for a Refund Advance loan with H&R Block. These include e-filing a tax return through a participating H&R Block office, expecting a sufficient refund from the IRS, and providing appropriate identification. Once these requirements are met, you submit an application to Pathward, the lender.

Pros and Cons of H&R Block’s Tax Refund Loans

The major draw for H&R Block’s Refund Advance loan is it comes with no interest or lender fees. You’re essentially getting an advance on your tax refund without any additional cost. The loan amounts range from $250 to $3,500, providing flexibility based on your anticipated refund. You can receive the funds as soon as the same day.

There are a few downsides to consider. The loan is only available for a limited time each year, between January and February, so if you need a tax refund loan outside of this period, you’ll have to look elsewhere.

You also must file your taxes in person at an H&R Block store to be eligible for the loan, which isn’t convenient for everyone. The tax-filing service is also more expensive in person than online (tax preparation fees at H&R Block start at $85). Lastly, the loan proceeds are only available on an H&R Block Emerald Prepaid Mastercard, which isn’t ideal if you prefer a direct deposit into a bank account.

Intuit TurboTax -Tax Refund Advance Loan

TurboTax, a product of Intuit Inc., is a leading tax preparation software that assists millions of users in filing their annual tax returns. One of the services TurboTax provides is a Tax Refund Advance.

Overview of TurboTax’s Tax Refund Advance

The refund advance loan is funded by First Century Bank and facilitated by Intuit TurboTax. Unlike the other tax preparers we’ve looked at, customers can apply online using TurboTax. Once approved, borrowers are required to open a Credit Karma Money checking account to access the loan.

Process of Applying for a Loan with TurboTax

Applying for a Tax Refund Advance with TurboTax is easy enough. You start by e-filing your federal tax return with TurboTax. During the filing process, you’ll have the option to apply for the Tax Refund Advance by providing a few more details. TurboTax will use this, along with the details from your tax return, to determine your eligibility for the advance. If your application is approved, you’ll have to open a Credit Karma Money checking account. This is where the loan amount will be deposited. Once the IRS accepts your tax return, the loan funds can be deposited into your Credit Karma Money checking account within 15 minutes.

Pros and Cons of TurboTax Refund Advance Loan

Fast access to funds is what most people want from a tax refund service, and TurboTax delivers on that. If approved, you can receive your loan within minutes of the IRS accepting your tax return. It also comes with no loan fees and 0% interest.

Most people prefer the convenience of applying for their Tax Refund Advance online, so TurboTax saves you time and effort on that front.

To consider the downsides, while the loan itself doesn’t have any fees, you may still be subject to tax preparation fees when filing with TurboTax. It also requires a Credit Karma Money Checking Account where the loan proceeds are deposited, so you’ll have to open a new account if you haven’t got one. There are also some residency restrictions; if you’re from Connecticut, Illinois, Nebraska, or North Carolina, you’re not eligible to apply. And as with the previous two companies we looked at, there are only certain times of the year that you can apply.

Below is a table that summarizes the pros and cons of the three providers discussed.

| Provider | Pros | Cons |

| Jackson Hewitt | Offers two types of tax refund loans with varying amounts. Has numerous locations nationwide for in-person application. | Requires taxes to be prepared by Jackson Hewitt. Funding can take up to five business days if opting for direct deposit. |

| H&R Block | Offers a no-interest, no-fee tax refund loan. Potential for same-day funding. | The loan is only available for a limited time each year. Requires in-person tax filing. Loan proceeds are only available on an H&R Block Emerald Prepaid Mastercard. |

| TurboTax | Allows online application. Provides fast access to funds. No loan fees or interest. | Requires opening a Credit Karma Money Checking Account. Residency restrictions apply. |

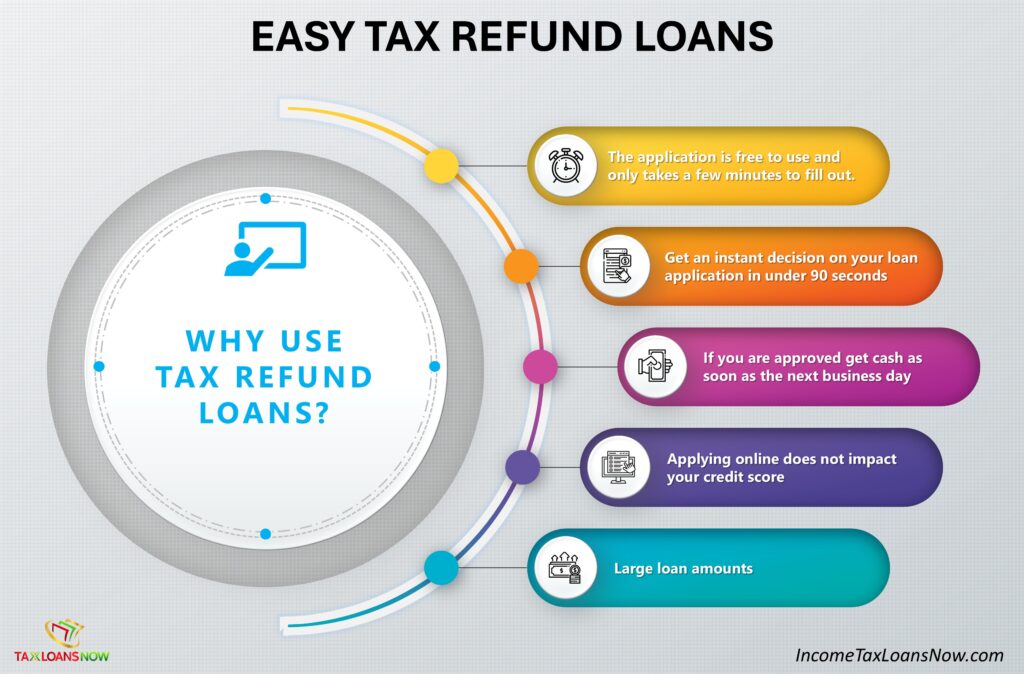

Pros and cons of Refund Advance Loans

Pros

- Quick access to your tax refund money

- No impact on credit score

- Helps bridge financial gaps

- Easy application process

- It can be used for any purpose

- No collateral required

- Potential for same-day funding

- Can be obtained with poor credit history

Cons

- Limited by refund amount

- Possible tax preparation fees

- Short repayment period

- Not available year-round from some providers

Tax Refund Loan Alternatives

Tax refund loans are an excellent solution for those seeking an early receipt of their tax refund, but they’re not the only option. Depending on your circumstances, one of these alternatives might be a better fit.

Installment Loans – these are loans that are repaid over a set number of scheduled payments or installments. Better if you need a larger loan amount and want more time to pay it back.

Line of Credit is a flexible loan where you draw funds up to a maximum limit, paying interest on the amount you use. It can be a good option if you need ongoing access to funds.

1-Hour Payday Loans are short-term loans you typically repay by your next payday. They can be a good option if you need cash quickly, as some lenders can provide funds within hours.

These are just a few examples; we have a wide range of tax refund loan alternatives at Income Tax Loans Now if you wish to go a different route.

Final Thoughts

So that concludes our article; we’ve looked closely at three major providers – Jackson Hewitt, H&R Block, and TurboTax. Each brings something unique to the table, from Jackson Hewitt’s duo of refund advances to H&R Block’s swift funding and TurboTax’s broad spectrum of loan amounts.

However, when it comes to flexibility, convenience, and a personal touch, Income Tax Loans Now might be a better option for you.

What sets us apart is the ease and speed of our online application process. You don’t need to travel to a tax provider’s office, and you can apply for your tax loan anytime, including weekends.

At Income Tax Loans Now, we work with a network of reputable lenders. This flexibility guarantees a personalized approach, matching you with a lender who understands your specific needs instead of offering a generic solution.

Consider all your options, whether it’s a tax refund loan from Jackson Hewitt, H&R Block, TurboTax, or the diverse financial services from Income Tax Loans Now, the right choice is the one that makes the most financial sense for you.

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...