If you’re having trouble keeping your bill payments current, you’re not alone! It doesn’t take much to unbalance a household budget, and once that happens the tendency is to slide farther and farther into the red each week. It’s a common problem, and the solution is faster and easier than you think.

The Best Income Tax Loans can be a great way to access that extra cash you need to make sure everything is paid up to date, so you don’t find yourself playing catch-up each month. You can borrow as little as $100 or as much as $5000, whatever you need to reach your break-even point.

The loan is repaid out of your next paycheck or two, and even longer extended payments are available which can make it easier to make those payments in addition to your regular bills.

Best Income Tax Loans Are the Fast and Easy Solution To Unexpected Bills and Expenses

Sometimes your bank or credit union is the right place to go to apply for credit, but if you need the cash urgently they may not be able to meet your deadline.

here’s a lengthy application process, and usually one or two people managing all the requests coming in. There’s always a wait to get a response, and then for the loan to be funded if you’re approved.

When you need your furnace repaired tomorrow, you don’t have time to wait. When you have a medical emergency and a trip to the ER empties your bank account, you need cash ASAP.

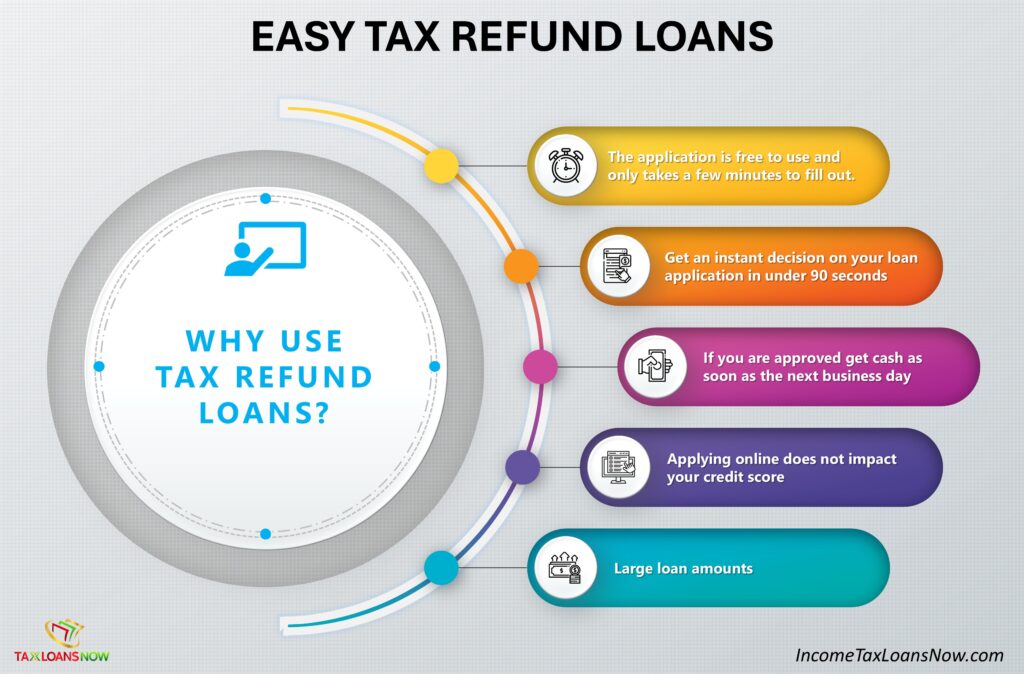

The Best Income Tax Loans can get you that cash you need within one business day – direct deposited to your own bank account so it’s available to spend right as soon as you need it.

How easy are they really? The application takes mere minutes to complete, and you’ll be notified of the decision even faster than that. Approvals take only 90 seconds, thanks to lenders who are available 24/7 for processing and approving loans for people like you who don’t have time to wait.

You can apply for income tax loans at any time, any day of the week, and get a response in less than two minutes.

How’s Your Credit Score? The Best Income Tax Loan Lenders Don’t Even Check!

If you’ve shied away from applying for credit because of the uncomfortable situation you find yourself in when the loan officer reviews your credit report, relax. You are eligible for the best income tax loans regardless of the state of your credit report.

While most lenders use the credit bureaus’ reports to determine your creditworthiness, Incme Tax Loan lenders choose to base their decisions only on your current circumstances.

The fact is, the late or absent payments on your credit report have no explanation accompanying them. Maybe you missed those car payments because you chose to spend your money on a vacation to the Bahamas or maybe the corporation where you had worked for fifteen years abruptly closed your department and laid off everyone who worked there.

Whether you have a steady job right now, making at least the minimum required monthly income, is a better measure than something unexplained that happened many months or even years ago!

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...