Tax Day, also known as the federal tax deadline, is an important date for all taxpayers in the United States. It’s the day when individual taxpayers must file their income tax returns with the Internal Revenue Service (IRS) and pay any taxes owed for the previous year.

Since 1955, Tax Day has traditionally fallen on April 15 unless it’s a weekend or holiday such as Emancipation Day. In the year 2024, April 15 falls on a Saturday, so the deadline is moved to the next business day, April 18, which goes right after the weekend and the District of Columbia’s Emancipation Day holiday, which falls on Monday, April 17.

With tax season in full swing, let’s dive deeper into the topic and learn more about the history of Tax Day and some key things you should know to make the process easier and less stressful.

How Tax Day Became an Annual National Event

The history of Tax Day dates back to the early 20th century when the 16th Amendment to the US Constitution was ratified in 1913 (with the filing deadline for individuals on March 1), granting Congress the power to levy taxes on income.

However, the federal income tax didn’t become a major source of revenue for the US government until World War II, when taxes were used to finance the war effort. Those times nearly doubled the number of Americans who would have to pay income taxes.

In 1955, the IRS established the deadline for individual tax returns as April 15. The organization picked this date because it was after the end of the fiscal year, which was March 31 at the time, and it gave taxpayers enough time to gather their financial records and prepare their tax returns.

In the years following World War II, the US economy grew rapidly, and more people “entered” the workforce. As a result, the number of individuals required to file tax returns increased, and Tax Day became a more significant event. To help taxpayers comply with tax laws, the IRS began to offer free assistance with tax preparation and expanded its outreach efforts to educate taxpayers about their obligations.

By the 1970s, Tax Day had become an annual national event. The media began to cover the event extensively, with news stories about long lines at post offices and tax preparation centers. The IRS began to offer electronic filing, making it easier for taxpayers to file their returns from home.

In 1984, Tax Day was moved from April 15 to April 16 to avoid a conflict with a holiday in Washington, DC, called Emancipation Day. Emancipation Day celebrates the end of slavery in the District of Columbia, and it is observed on April 16. Since then, Tax Day has occasionally been moved to April 17th or 18th, when April 15 falls on a weekend or a holiday.

Today, Tax Day remains an annual national event, with millions of taxpayers filing their returns each year.

Taxation Without Frustration: Tips for Surviving Tax Day

Tax season can be a stressful time for many people. Filing your taxes and making tax payments can seem overwhelming, but with a little preparation and organization, you can make tax day less frustrating. Here are some tips to help you survive tax day.

Start Early and Stay Organized

Don’t wait until the last minute to start preparing your tax return. Start early and keep all your financial documents and receipts compiled in one place. This can help you avoid any last-minute rush and ensure that you have all the necessary information on hand to complete your tax return.

Know Your Taxable Income

Your taxable income is the amount of money you earn that is subject to federal income tax. It’s calculated by subtracting your deductions from your total income. The higher your taxable income, the more taxes you will owe. Understanding your adjusted gross income (AGI) can help you plan for tax payments and estimate your tax refund.

Use Tax Software

Tax software may save you from the dreaded “math brain” that strikes each tax year. It can help you accurately calculate your tax payments, deductions, and credits; and ensure you don’t miss any important tax information.

Make Estimated Tax Payments

If you are self-employed, a freelancer, or have other sources of income that are not subject to withholding, you may need to make estimated tax payments throughout the year.

This can help you avoid penalties for underpaying taxes and stay on the good side of the IRS.

Take Advantage of Tax Credits

Tax credits can help reduce the amount of taxes you owe or increase your tax refund. For instance, if you have a Health Savings Account (HSA), you may be eligible for a tax credit for contributions made to the account.

Don’t Forget About State Taxes

While federal taxes get the most attention, don’t forget about state income taxes. You may be required to file a state tax return and make state tax payments, depending on where you live and work.

File for an Extension If Necessary

If you, for any reason, need more time to file your tax return, you can file for an extension. This can give you an additional six months to file your tax return, but it doesn’t extend the tax filing deadline.

How to File a Tax Extension in 2023

To file a tax extension in 2023, follow these steps:

- Estimate your tax liability: Calculate how much you owe in taxes for the year using the available information. This will help you determine how much you should pay when requesting an extension.

- File Form 4868: To request an extension, you will need to file Form 4868 with the IRS. You can do this electronically or by mail. If you file electronically, you’ll receive a confirmation that the IRS has received your request.

- Pay estimated taxes: If you owe taxes, you should pay as much as you can when you file for the extension. This will help minimize any penalties and interest charges you may owe.

- Set a new deadline: Once your extension is granted, you’ll have until October 15, 2023, to file your tax return.

Important note: filing for an extension does not give you more time to pay taxes. You’ll still need to estimate your tax liability and pay as much as you can when you file for the extension. You could face penalties and interest charges if you don’t pay enough.

Why You Should Use IRS Free File

The whole process of filing taxes is usually quite painstaking. Thanks to the IRS Free File Program, you can take advantage of the hassle-free route.

This program allows eligible taxpayers to file their federal tax returns for free, using tax software provided by leading companies.

One of the greatest benefits of using the IRS Free File is that it’s completely free. This can save you tons of money compared to hiring a tax professional or using paid tax software. Additionally, the program is easy to use and can guide you through the whole process of filing your taxes step-by-step.

Another advantage of using IRS Free File is that it can help you avoid common mistakes that could lead to delays or even penalties. The software provided through the program is designed to catch errors and ensure that your return is accurate, which can give you peace of mind when filing your taxes.

You’ll need to meet specific eligibility requirements to use the IRS Free File. This includes having an adjusted gross income (AGI) of $73,000 or more for the 2023 tax year. Additionally, some participating companies may have their own eligibility requirements, so be sure to check the program’s website for more details.

The Bottom Line

This year tax day falls on April 18, which goes right after the weekend and the District of Columbia’s Emancipation Day holiday.

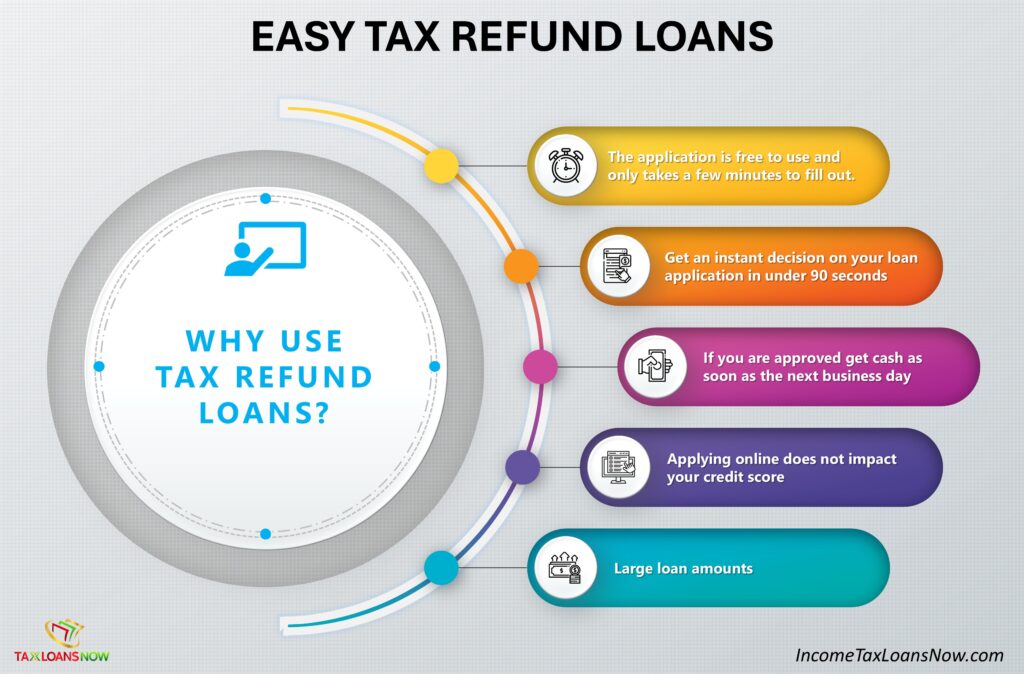

For many people, tax filing season is an extremely stressful period, especially if one, for any particular reason, doesn’t have the cash on hand. In this case, Income Tax Loans Now, which may help you avoid penalties and stay on top of your finances, is a real game changer.

If you are looking for the best refund advance online that offers instant tax refund loans that are both safe and secure, look no further than Income Tax Loans Now!

Apply now and get the money in your account as soon as the next business day or even sooner.

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...