Is getting a property tax loan a wise move or a risky venture? Before you decide, here are some key considerations to keep in mind.

Take a Good, Hard Look at Your Financial Situation

Before diving headfirst into a property tax loan, take a good look at your financial situation.

Start with the basics: What’s your monthly income like, and where does most of it go? Are there any outstanding debts, like credit cards or other loans? How much do you have stashed away in your rainy day fund?

Next, ask yourself these tough questions.

Can you afford the monthly payments that come with a property tax loan? It’s wise not to stretch yourself too thin. An overburdened budget can quickly turn into a ball and chain.

What’s your financial outlook for the foreseeable future? If you’re anticipating any significant changes, like a major expense, consider how this may affect your ability to repay a property loan.

Do Your Due Diligence

Those interest rates that lenders charge on property tax loans aren’t just numbers; they’re how they make their bread and butter. But here’s the thing: Not all lenders are cut from the same cloth.

Some lenders are transparent, have reasonable terms, and genuinely want to help you out.

Then there are others who are, well, let’s just say they’re more interested in lining their own pockets.

You might encounter hidden fees, sky-high interest rates, or terms that are about as clear as mud.

So do your research, and as you do so, remember the saying, “Trust, but verify,” and make sure to apply it.

Even if a lender seems reputable, take the extra step to confirm. Look them up online, read reviews, and maybe even consult financial forums where people share their experiences.

Also, don’t shy away from asking questions. This is your financial wellbeing we’re talking about. Ask about everything from how the interest is calculated to what happens if you miss a payment. The more you know, the better equipped you’ll be to make an informed decision.

Compare Loan Options

Taking out a property tax loan is no easy matter; therefore, take your time and shop around.

Why? Because every lender has different terms, rates, and fees. Some lenders may offer a lower interest rate, but with a shorter repayment period. Others might give you more flexible terms, but at the cost of a higher interest rate.

The best way to evaluate different loan options is by obtaining quotes from various lenders. These quotes are typically available on lenders’ websites or can be obtained by a simple request over a phone call or through an online form.

Each quote should contain important details like interest rates, loan terms and conditions, and potential hidden fees.

Ensure to put the details of these quotes side by side for an easy comparison. This will provide a clear map of what each lender brings to the table.

Comparing the quotes will not just shed light on the costs, but also reveal the degree of flexibility and fairness in the terms each lender offers.

Consider the Implications on Your Property

A property loan, much like other loans, places your property as collateral. This means that should you miss payments or default, the risk of losing your property may well become a reality.

And this goes back to our first point: understand your financial situation.

While you might be desperate to settle your tax debt, rushing into a loan without fully grasping the consequences is not advisable.

Explore Alternative Solutions

If you have a wealthy friend or relative who has helped you financially once or twice, you could reach out to them and have a heart-to-heart discussion about your situation. They might be willing to lend you the necessary funds with a flexible payment plan in mind.

If you’re not so lucky, there are other options. You could check with your local tax office about payment plans or delaying your payment. Also, think about other types of loans, like a personal loan.

Look into options around your home, too. You might have assets you can sell, such as furniture or electronics, to cover your tax bill. Or perhaps you have extra space and can consider renting out a room for additional income.

Wrap Up

Getting a property tax loan is a big decision that needs careful consideration. Remember, if you decide to take a loan, it will be tied to your home. Which means that if you default on the loan, there is a risk that you may lose it.

So evaluate your financial situation to see if you can actually afford to pay off the loan comfortably.

But most importantly, consult with a financial professional before you apply for the loan. The last thing that you want to do is take on more debt than you can handle and end up defaulting on your loan.

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

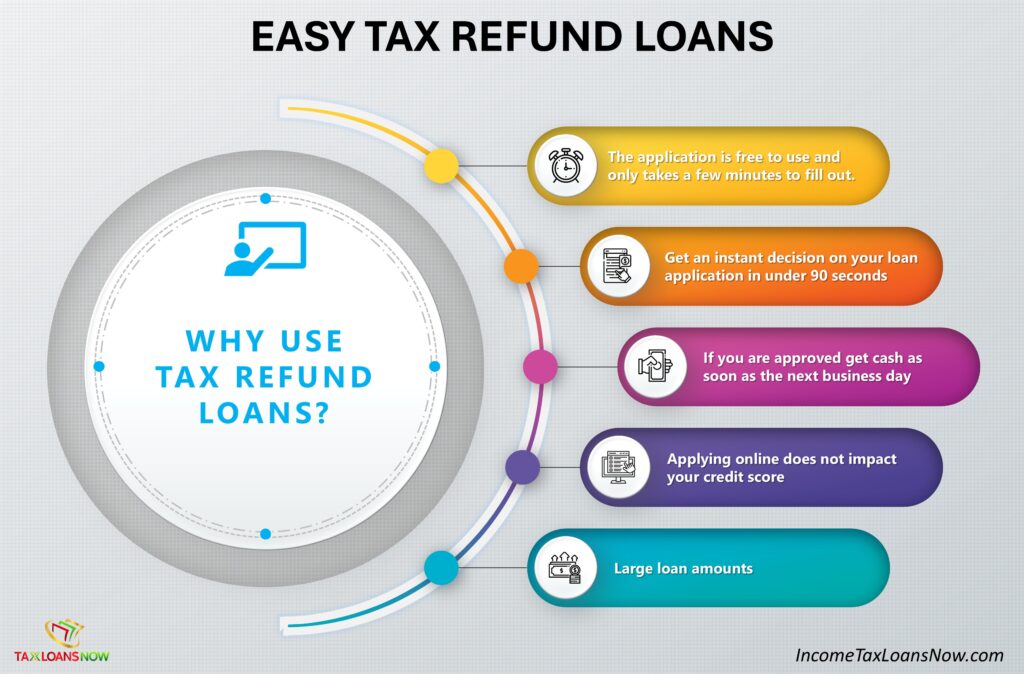

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...