Everyday, people just like you, who work hard and still barely earn a living, turn to cash advance loans to get financial assistance. You may be working full time, you may even have two jobs to make ends meet, and yet your paycheck isn’t always enough.

Many typical jobs don’t pay enough to support families in this day and age and to get by, you have to budget extremely well. For those times when your most careful planning goes out the window, you can turn to places that do income tax loans.

Why People Use Income Tax Loans

If you’re not sure your situation merits the use of income tax loans, seeing how other people use them may put you at ease. Turning to this method of financing is a popular choice for anyone who needs just a small loan, has bad credit, or needs cash really quickly.

The paycheck ran out

The number one reason people use cash advance loans is that the paycheck just didn’t last two weeks. When payday is still a few days away, and you have bills to pay, income tax loans can help.

You have an emergency

When you make minimum wage, it’s hard to budget extra money for emergencies. So, in a situation when you need to make some quick home repairs, pay for a medical bill, or make an urgent trip to one of your family members living across the country, taking out a tax refund loan may be your best shot to get the money you need quickly.

The car broke down

Paying for car repairs is a popular reason to get a loan. If you can’t drive, you can’t get to work, and you can’t earn money. For many families, it’s the worst-case scenario, which is why some of them consider the loan solution.

Your checking account is overdrawn

The fees that come with an overdrawn account can be outrageous. Avoid them with income tax loans.

Your credit cards are maxed out

You’ve been relying on credit cards to pay for things you need, but your credit will eventually run out. This is the point at which you may have very few options left to get the money and cover your basic living expenses. An advance tax loan can be a suitable solution in such a situation.

Why Apply for a Tax Refund Loan – Pros and Cons

Like any other solution, tax refund loans come with a set of pros and cons worth considering before applying. What are some of them?

Pros

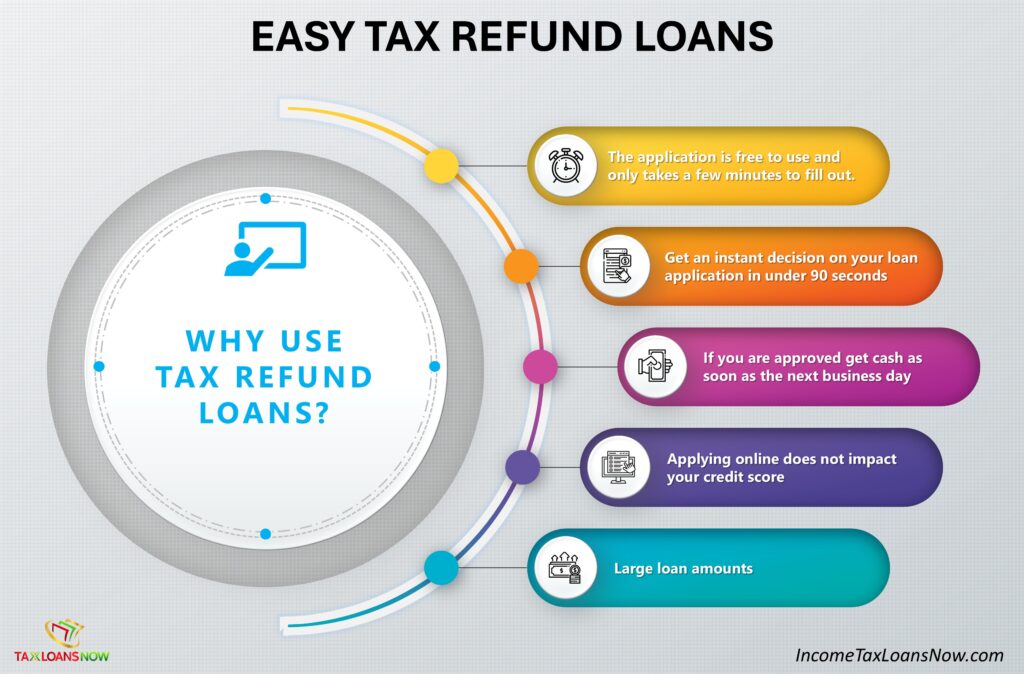

- Quick access to cash – The whole appeal of income tax loans? They offer you incomparably quick access to the money you need. Oftentimes, cash can be transferred to you in the next business day from your application date. There’s no real waiting period.

- Easy application process – Another crucial advantage of tax refund loans is the straightforward application process. If you’re using Income Tax Loans Now, all you have to do is fill out an online form, and within seconds, you’ll receive your answer. We will match you with the best lender, and you’ll get your money. No hassle, no stress, no complicated procedures.

- Bad credit is not a problem – You can qualify for a tax refund loan with bad credit. Lenders we work with don’t perform hard credit checks, so qualifying for a loan is more than possible for you! You can use your income as a good credit.

- Favorable requirements – There are very minimal requirements you need to meet to qualify for a loan. You need to have an income, checking or savings account, be 18 years old and older, and be a US citizen. That’s it. You can apply for a loan before or after you file your tax forms, so this solution is available to you throughout the whole year!

Cons

- Potentially high-interest rates and fees – Short-term loans, like income tax loans, usually come with higher interest rates. They are still smaller than those offered with payday loans, but these costs should be considered. Additionally, you may be subjected to fees, which will also increase the cost of the loan.

- The loan repayment may be higher than your tax refund – As you’re taking an income tax loan against the estimated amount of your tax refund, there’s always a possibility that your tax refund will be smaller than the amount you borrowed. That is why it’s important to have an income source so you can cover these unforeseen expenses without defaulting on your loan.

- You may have to use a tax preparer – In some cases, it might be necessary to pay additional fees for your lender to prepare and file your tax forms. However, you still can apply for a loan with your taxes already filed, so these costs may not apply.

How You Can Qualify for Income Tax Loans

Qualifying for income tax loans using an intermediate like Income Tax Loans Now is easier than you may think. For most lenders, minimum requirements include U.S. citizenship, being at least 18 years old, and proving that you earn a regular paycheck.

It’s really that simple to qualify for income tax loans that can really help you out in tough times.

How to apply for a tax refund loan?

The application process is simple and quick, especially if you go with online lenders.

All you need to do is fill out your application form, including all the relevant documentation, like tax returns or W-2 forms, and wait for instant approval.

The next step is to read through the loan’s terms and accept them. You should be able to get the cash you need later the same day or early the next day.

Income Tax Loans – A Solution for You

Income Tax Loans are easy and fast. If you’ve exhausted all the other options and you need quick cash to cover some unexpected expenses, a tax refund loan might be the best answer for you.

At Income Tax Loans Now, we take pride in helping people like you find a trusted lender. No hidden fees, no endless waiting for approval, no hard credit checks.

Steve Mccaffrey

Author

Steve is a top contributing author and best seller. He has been featured on several programs and brings his extensive knowledge to our business and blog section. He is a dedicated to his family and his craft.

Related Reading

Easy Tax Refund Loans

[lwp_divi_breadcrumbs _builder_version="4.27.4" _module_preset="default" theme_builder_area="post_content"...

Fastest Early Tax Refund Loans

Is There A Way To Get A Loan On Your Tax Refund? Yes there is a way to get a loan on your tax refund....

Borrow Money Black Friday

Can I Borrow Money for Black Friday 2024? Yes, it is possible to get cash by applying for a loan...